Canada’s electric vehicle (EV) adoption strategy, long anchored by federal and provincial purchase incentives, is undergoing a seismic shift in 2025. The abrupt pause of the federal Incentives for Zero-Emission Vehicles (iZEV) program and the scaling back of provincial rebates have sparked debates about the future of EV affordability, market dynamics, and Canada’s ability to meet its climate targets. This article examines the role of EV incentives in driving adoption, the timeline of their discontinuation, and the cascading effects on consumers, automakers, and policymakers.

The Role of EV Rebates in Canada’s Transition

Canada’s EV incentive programs, introduced to accelerate the transition from internal combustion engines, have been pivotal in reducing upfront costs for consumers. The federal iZEV program, launched in 2019, provided up to $5,000 for battery−electric vehicles (BEVs) and $2,500 for plug-in hybrids (PHEVs), contributing to over 546,000 ZEV sales nationwide. Provinces like Quebec and British Columbia (B.C.) layered additional rebates, creating a “stackable” system that significantly lowered EV prices. Quebec’s Roulez vert program, offering up to $7,000, and B.C.’ sincome−tested $4,000 CleanBC rebate, helped these provinces dominate national EV sales, accounting for over 60% of purchases since 2019.

These incentives addressed key barriers to adoption: high upfront costs and consumer skepticism. A TD Economics report noted that BEVs remain 31% more expensive than gas-powered counterparts, underscoring the rebates’ role in bridging this gap. Ontario’s experience after canceling its $13,000 rebate in 2018 — a subsequent 66% sales decline in B.C. post-2024 adjustments — illustrates the fragility of demand without subsidies

When Rebates End

Federal Program Collapse

The iZEV program was initially set to expire on March 31, 2025, but overwhelming demand drained its $71.8 million fund by January 13, 2025, forcing an early pause. Transport Canada’s abrupt announcement left dealers and consumers scrambling, with critics lambasting poor communication and planning. The depletion followed Quebec’s December 2024 decision to suspend its provincial rebate in February 2025 due to depleted funds, exacerbating nationwide uncertainty.

Provincial Rollbacks

l Quebec: Reduced its BEV rebate from $7,000 to $4,000 in 2025, with plans to phase it out entirely by 2027.

l B.C.: Tightened eligibility by lowering the vehicle price cap to $50,000 and restricting rebates to households earning under $80,000.

l Newfoundland and Labrador: Ended its $2,500 rebate on March 15, 2025.

These changes reflect a broader trend: governments view rebates as temporary tools to “kickstart” markets, not permanent subsidies. However, the suddenness of these cuts—amid rising EV prices and lagging infrastructure—has left stakeholders questioning Canada’s commitment to its 2035 ZEV mandate.

What’s Next for Canada’s EV Market?

Market Slowdown and Consumer Hesitation

The removal of rebates is expected to dampen EV sales, particularly among middle-income buyers. Analysts predict a near-term decline similar to Ontario’s post-2018 experience, where sales lagged behind Quebec and B.C. despite federal incentives. Brian Kingston of the Canadian Vehicle Manufacturers’ Association warns that the federal government’s 2026 target of 20% ZEV sales is now “increasingly unrealistic”.

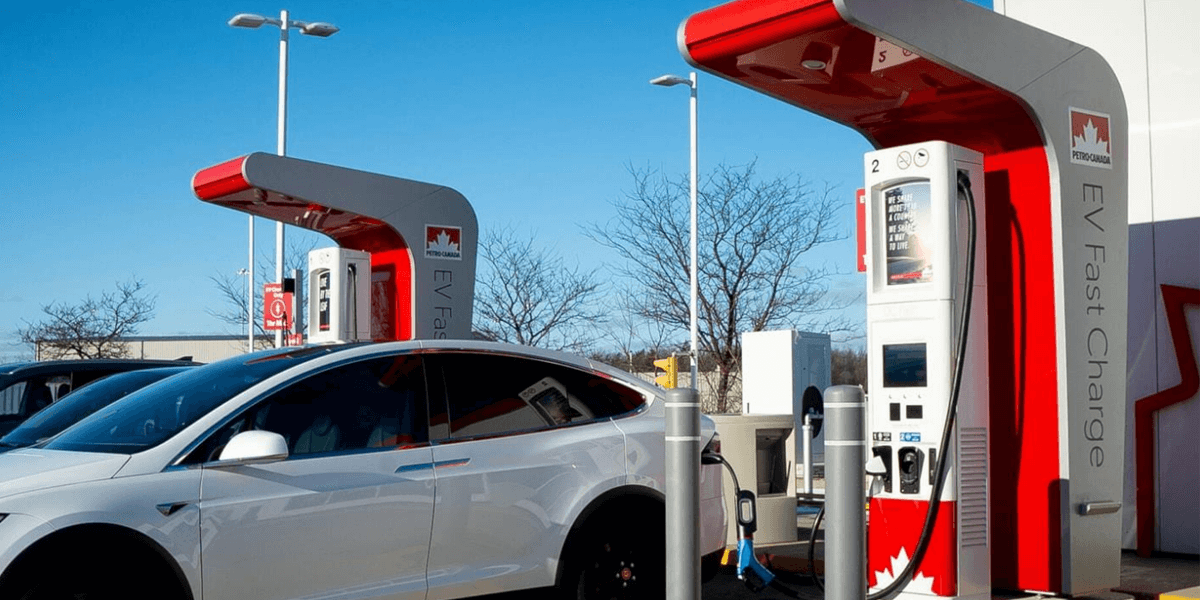

Infrastructure Gaps and Policy Paralysis

Canada’s charging network remains underdeveloped, with public stations concentrated in urban centers. The rebate pause coincides with slowed infrastructure investments, further eroding consumer confidence. Meanwhile, political turbulence—including Prime Minister Trudeau’s resignation and a potential Conservative victory in 2025—casts doubt on future policy continuity.

Shifting Focus to Commercial Fleets

While passenger EV incentives fade, federal and provincial programs for medium- and heavy-duty vehicles (MHDVs) persist. The iMHZEV program, offering up to $200,000 per vehicle, continues until March 2026. Quebec’s suspended Écocamionnage program and B.C.’s Go Electric rebate signal a strategic pivot toward decarbonizing freight and public transit. However, these initiatives face their own funding challenges, as seen in Quebec’s September 2024 program halt.

Lessons from Global Markets

Canada’s situation mirrors global trends. China’s EV adoption, driven by a mix of subsidies and infrastructure investments, highlights the need for long-term policy stability. Similarly, the U.S. faces uncertainty as President Trump prepares to scrap federal EV tax credits. For Canada, a hybrid approach—combining targeted incentives, manufacturing support, and infrastructure expansion—may be essential to sustain momentum.

Conclusion: Navigating a Post-Rebate Era

Canada’s EV transition is at a crossroads. The disappearance of purchase incentives exposes systemic vulnerabilities: reliance on subsidies without parallel investments in affordability, infrastructure, and industrial policy. To avoid backsliding on climate goals, policymakers must recalibrate strategies—whether through tax reforms, low-interest loans, or bolstered charging networks. As Flavio Volpe of the Automobile Parts Manufacturers’ Association noted, the iZEV program’s focus on imports, rather than domestic production, underscores missed opportunities for economic synergy.

The coming years will test Canada’s ability to innovate beyond rebates. Success will hinge on aligning federal-provincial agendas, fostering public-private partnerships, and ensuring that EVs remain accessible to all Canadians—not just the affluent. Without such measures, the vision of a zero-emission future risks stalling before it truly begins.

Recommend Reading: A Shift to Electric: Canada’s Electric Vehicle Incentive Programs

Share:

Electric Cars: Built to Last Longer Than Expected

What is a NEMA 5-15 Plug? Comprehensive Guide to Its Features, Uses, and Applications