A Turning Point for EV Battery Chemistry

In 2025, lithium-iron phosphate (LFP) batteries officially surpassed nickel-based chemistries in global electric vehicle deployments for the first time. According to industry data cited by EV Magazine, this milestone marks a structural shift in how EVs are powered—and a decisive moment for battery cost, sourcing, and manufacturing strategy worldwide.

For more than a decade, nickel-manganese-cobalt (NMC) batteries dominated EVs thanks to their higher energy density and early supply-chain maturity. But as the EV market scaled, the weaknesses of nickel-heavy chemistries became harder to ignore. LFP’s rise is not a sudden trend—it is the result of economics, geopolitics, and rapid technical progress converging at the same time.

Why Automakers Moved Away From Nickel and Cobalt

NMC batteries earned their popularity by enabling longer driving range, a critical selling point in early EV adoption. Most EVs sold in the U.S. still rely on NMC packs for this reason.

However, those advantages come with significant downsides. Nickel and cobalt are expensive, environmentally intensive to mine, and tied to unstable or controversial supply chains, particularly cobalt sourcing from the Democratic Republic of Congo. These materials expose automakers to price volatility, regulatory risk, and reputational concerns.

As EV volumes increased, battery cost—not peak range—became the limiting factor. That shift pushed manufacturers to accelerate investment in nickel-free alternatives like LFP.

How LFP Closed the Performance Gap

Historically, LFP batteries suffered from lower energy density, which translated into shorter range. That disadvantage has steadily narrowed.

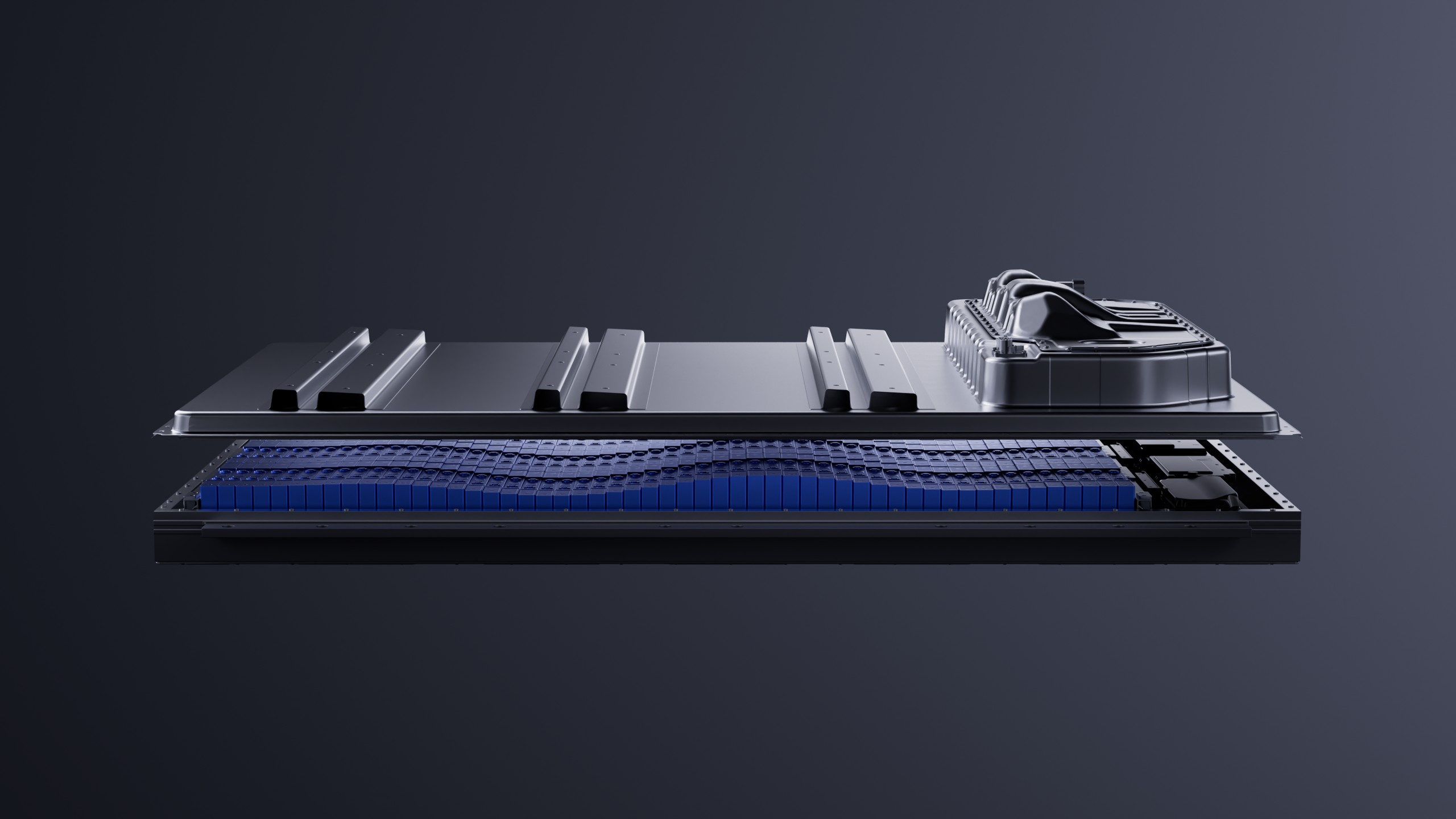

New vehicle architectures such as cell-to-pack and cell-to-chassis designs allow automakers to fit more LFP cells into the same footprint, offsetting density limitations. Improvements in anode and cathode materials have further boosted efficiency and durability.

At the same time, LFP offers clear benefits: longer cycle life, better thermal stability, and lower fire risk. For mass-market EVs, fleets, and entry-level models, LFP delivers “good enough” range at a far lower cost, which increasingly matters more than maximum specifications.

China’s Lead in LFP Adoption and Scale

China has been the clear driver behind LFP’s global rise. In 2025, more than 80% of EVs sold in China used LFP batteries, reflecting a market that prioritizes affordability, domestic sourcing, and manufacturing scale.

Battery giants like CATL dominate the space. Roughly one-third of all EVs sold worldwide last year used CATL cells, underscoring China’s influence not just in vehicle production, but across the entire battery ecosystem.

That dominance is now extending beyond China’s borders. Europe and Asia (excluding China) accounted for roughly three-quarters of global LFP growth, largely due to Chinese automakers expanding overseas. Brands like BYD, Leapmotor, and Chery posted strong gains across Europe in 2025.

Europe Embraces LFP Through Local Production

To reduce tariff exposure and stay close to customers, Chinese battery manufacturers are investing heavily in European production. CATL and BYD are building large-scale battery plants in Hungary, while CATL already operates a facility in Germany and is planning another in Spain with Stellantis.

This localization strategy allows LFP batteries to integrate more deeply into Europe’s EV supply chain, making them harder to exclude and easier for automakers to adopt at scale.

Why North America Is the Exception—for Now

North America was the only major region where LFP adoption declined in 2025. U.S. tariffs and sourcing rules under the Inflation Reduction Act have effectively blocked China-made batteries, limiting LFP availability.

Some automakers still offer LFP-equipped vehicles, including base trims of the Ford Mustang Mach-E and Rivian R1T and R1S. Tesla previously sold an LFP-based Model 3 in the U.S., but discontinued it due to tariffs.

That may change. Affordable EVs like the upcoming Chevrolet Bolt and Ford’s planned $30,000 electric truck are expected to revive interest in LFP, especially as domestic production ramps up.

The Bigger Picture: LFP Beyond Passenger EVs

In the U.S., much of LFP’s near-term growth may come from battery energy storage systems (BESS) rather than cars alone. As EV tax credits phase out, companies like LG Energy Solution, Tesla, and SK On have shifted capacity toward stationary storage, where LFP’s longevity and safety are ideal.

Why LFP Won in 2025

LFP did not become dominant because it is the most advanced chemistry on paper. It won because it is cheaper, safer, scalable, and increasingly “good enough” for real-world use. In a market moving from early adopters to mass buyers, those traits matter more than ever.

Recommend Reading: Why Some EVs Are Designed to Be Charged to 100%

Share:

Germany Revives EV Incentives With Broader Eligibility and Fewer Restrictions

Mazda Delays Its Next EV as Hybrid Strategy Takes Priority