How Benchmarking Shaped Tesla’s Mass-Market Strategy

Automakers routinely purchase and tear down competitors’ vehicles to study engineering choices and cost structures. Tesla followed the same practice during the development of the Model 3 and Model Y—two models that would later define the global EV market.

Former Tesla president John McNeill, who served from 2015 to 2018, says these benchmarking exercises were especially influential when Tesla analyzed fast-rising Chinese EV manufacturers. He described Tesla at the time as “a learning sponge,” eager to adapt proven ideas that could improve cost efficiency and manufacturing speed.

The Key Lesson: Extreme Component Reuse

A Strategy Refined in China

In a recent interview with Business Insider, McNeill explained that Chinese automakers were remarkably disciplined in reusing components across multiple models. While Western manufacturers also rely on shared parts, Chinese EV brands took parts commonality to an unprecedented level.

According to McNeill, “If you tear down all the BYDs—same windshield wiper motor across all of them; same heat pump across all of them; same conduit across all of them.”

These unseen components don’t affect the driving experience, he said, but they massively reduce engineering costs, simplify supply chains, and shrink production timelines.

Tesla Adopted the Approach During Model 3/Y Development

Tesla already understood the advantages of platform sharing, but the teardown findings reinforced the company’s focus on cost-driven design.

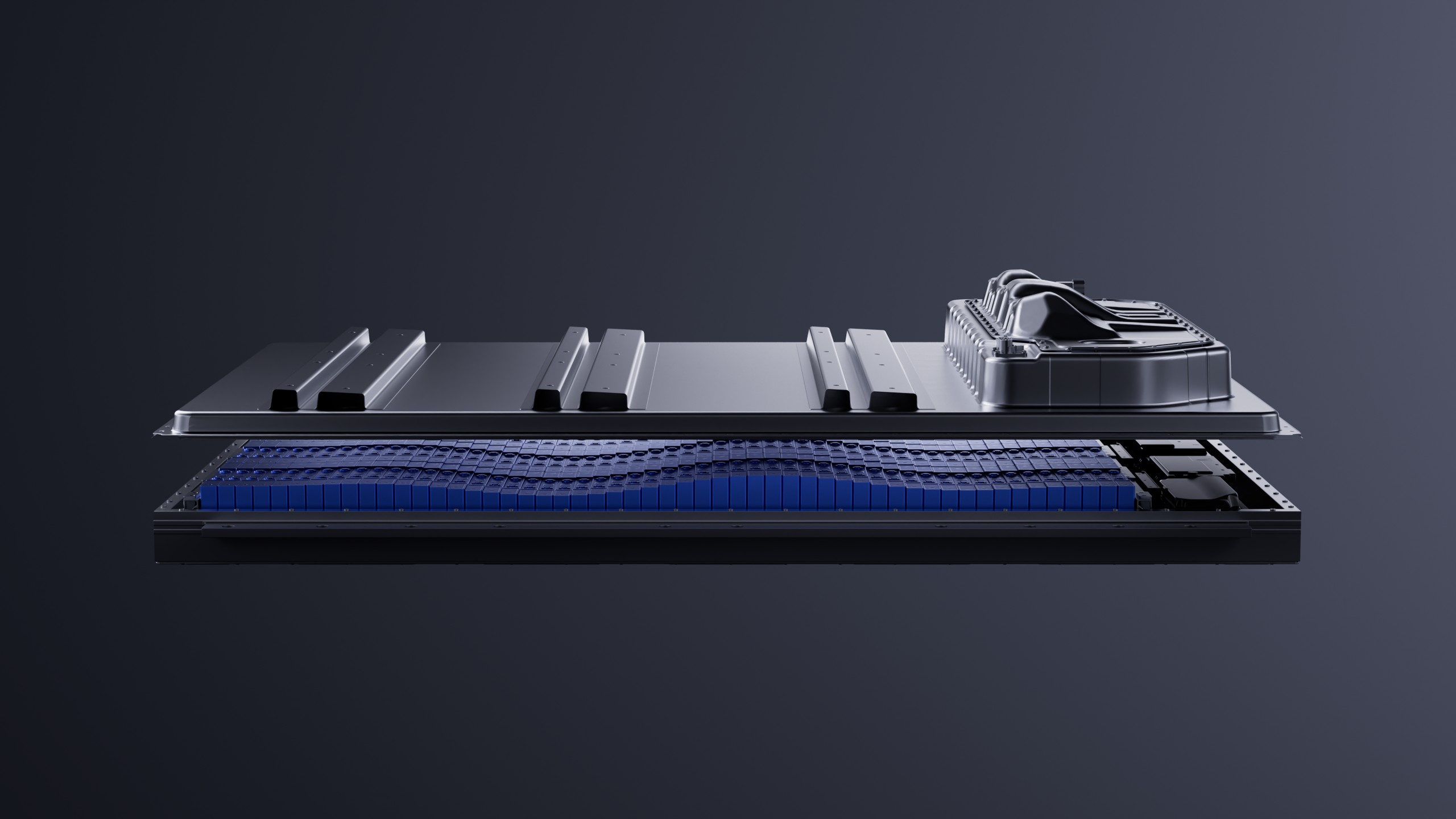

The Model 3 and Model Y ultimately shared about 75% of their components, including their platform, powertrain architecture, interior modules, and even small hardware like switches and door mechanisms. Front seats are nearly identical, simply installed at different heights.

This design philosophy allowed Tesla to streamline manufacturing and offer aggressively priced EVs in the U.S. and Europe—a key factor behind the Model 3’s immediate success.

Cost Advantages Fueled Tesla’s Early Global Surge

The first full sales year for the Model 3, 2018, saw roughly 138,000 units sold in the U.S., making it the country’s best-selling premium car regardless of powertrain.

China followed shortly after. With production ramping at Gigafactory Shanghai, the Model 3 became China’s best-selling plug-in vehicle in 2020, matching its U.S. momentum. The model effectively set the global standard for a mass-market EV.

Why the Strategy Isn’t Enough in China Today

Local Rivals Have Surpassed Tesla on Value and Technology

While Tesla once benefitted from ideas inspired by Chinese EVs, the competitive landscape has shifted dramatically. Chinese automakers now deliver:

-

Lower prices

-

Faster charging

-

More advanced cabin software

-

Features tailored to local consumer expectations

As a result, Tesla’s China sales have steadily weakened, reaching a three-year low in October and dropping from 8.7% to 3.2% market share year over year.

Cost Cutting Alone No Longer Works

McNeill noted that Tesla remains “absolutely relentless” in pursuing cost reductions. But in a market where value, software, and rapid innovation are reshaping consumer preferences monthly, efficiency alone cannot close the gap.

Tesla Still Leads Outside China—but Faces Growing Pressure

Globally, Tesla sales have softened even as its vehicles remain competitive. The company still offers the strongest long-distance charging ecosystem outside China thanks to the Supercharger network, and its vehicles continue to deliver highly efficient performance.

However, as global automakers adopt faster charging technologies, expand software ecosystems, and chase lower pricing, Tesla’s early cost advantages may no longer guarantee leadership.

Recommend Reading: Tesla’s Sales Collapse in Europe as BYD Surges to Record Growth

Share:

Tesla FSD Shows Surprising Defensive Maneuvers in Controlled Stress Test

Hyundai Opens $817M Battery Campus to Advance Next-Gen EV Innovation